The Economic and Financial Affairs Council has concretised legal details of chain transactions on 4 December 2018. The new regulations have been approved through so-called “Quick Fixes”. Systematically, the new regulations will be integrated in Article 36a of Directive 2006/112/EC. The new VAT regulations do not concern constellations involving non-member countries: The new rules are only applicable between EU member states.

Chain Transactions

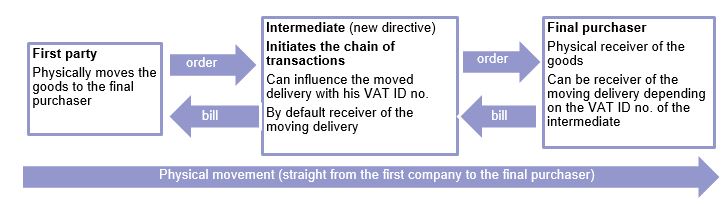

Chain Transactions are determined as transactions with multiple consecutive deliveries between (at least) three parties. Within the delivery chain, at least one physical movement of goods is obligatory. This actual transport process has to occur between the first and the last party within the transportation chain. Since there is de facto only one movement of goods, only one delivery process can be the delivery that the intracommunity supply is allocated to (here: “moving delivery”). The remaining delivery procedures are dormant. The new regulations simplify the determination of the moving delivery under certain circumstances. Only intra-EU trading constellations that are initiated by the intermediary are governed by the new regulations.

From a VAT perspective, the correct interpretation of the legal procedures was problematic due to different national regulations. The idea behind the implementation in Article 36a are legal certainty and an overall step to eliminate national inconsistencies and international fragmentariness.

Modifications

With the implementation of the new regulations, chain transactions are determined as above within all EU member states (regarding intra-EU trading constellations, initiated by the intermediary). In Austria, that definition is already in use to interpret certain VAT cases. Currently, the initiation of the movement determines the moving delivery. The receiver of the moving delivery is the party that initiates the movement of goods.

In contrary to the current situation, the intermediate now has the possibility to change the assignment of the moving delivery under the Article 36a of Directive 2006/112/EC. The intermediary receives the moved delivery when he initiates the chain of transactions, unless he chooses to use the VAT identification number of the country of departure. In this specific case, the moving delivery goes from the intermediary to the next party within the chain of transactions.

For example (with three involved companies under the terms and conditions of the new legal situation)

Conclusion:

The new regulations are very restrictive in use. The unifying rules are only applicable under certain intra-EU trading constellations. In all the other cases, there is still no definitive VAT system for intra-EU trading. For example, if the first or the last in the supply chain initiates the chain of transactions, Article 36a of Directive 2006/112/EC is not applicable. These cases have to be examined under the existing judicature. The main issue is the determination in which country the power of disposition was transferred to the final purchaser. A comprehensive regulation of all constellations regarding the chain of transactions would be preferable – at least within the EU area.