Has your business been affected by the COVID-19 pandemic? It may also have an impact on your transfer pricing.

Has your business been affected by the COVID-19 pandemic? It may also have an impact on your transfer pricing.

Companies have been experiencing fluctuations in revenues and cash flows and facing forced closures during the pandemic. On the other hand, certain segments and companies have strengthened their position significantly. Many countries have intervened and provided subsidies to help national businesses in order to protect local economies and preserve jobs. During the pandemic, independent companies and businesses in the market reacted differently to the new economic conditions. The companies have re-evaluated their existing business strategies and contractual arrangements with third parties. Economic entities faced and continue to face new kinds of risks.

All these changes also have an impact on price comparisons and profitability of transactions with related parties. The Organisation for Economic Co-operation and Development has therefore issued guidance on the impact of the COVID-19 pandemic on transfer pricing, addressing, for example, the comparability of data for the purposes of comparability analysis as well as the potential impact of government support programmes on transfer pricing.

As the issue of transfer pricing becomes even more complex, the correct application of the guidance can be crucial for companies. A few practical conclusions can be drawn from this; some may probably be useful for your company, as well.

- If the industry in which you operate has been affected by the pandemic, you may need to update the comparability analysis or quantification of the impact of the pandemic.

- If you have received a government subsidy, taxpayers should perform an analysis to determine the impact of government aid programmes on their operations and their market and adjust their transfer pricing accordingly.

- If your group or company has faced significant losses and new risks, you need to update your functional and risk profile and consider the allocation of losses or specific costs within the group of companies.

The Financial Administration will focus more on transfer pricing in tax audits.

In the first half of the year, the Financial Administration announced that the Office for Selected Economic Entities will invite 889 taxpayers to voluntarily complete a simple questionnaire focused on transactions they have carried out with related parties for the tax period of the calendar year 2020, or for the tax period other than the calendar year that ended in 2020. The Tax Administration expects that by analysing the data, it will be able to fight tax evasion and possible tax avoidance more effectively. The data obtained will also be used to assess the need for legislative and non-legislative changes in the area of transfer pricing and their potential impact.

The Office for Selected Economic Entities is one of the institutions of the Financial Administration, which was established in 2019 by transforming the Tax Office for Selected Taxpayers. Its scope includes banks or branches of foreign banks, insurance and reinsurance companies and branches of foreign insurance and reinsurance companies, securities dealers, pension management companies or supplementary pension companies, payment institutions, entities with the status of an approved economic entity, tax entities that have achieved an annual turnover of EUR 40 million or more for each of two consecutive tax periods.

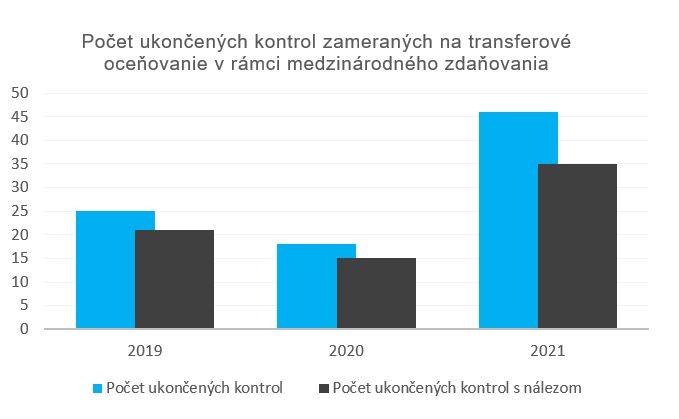

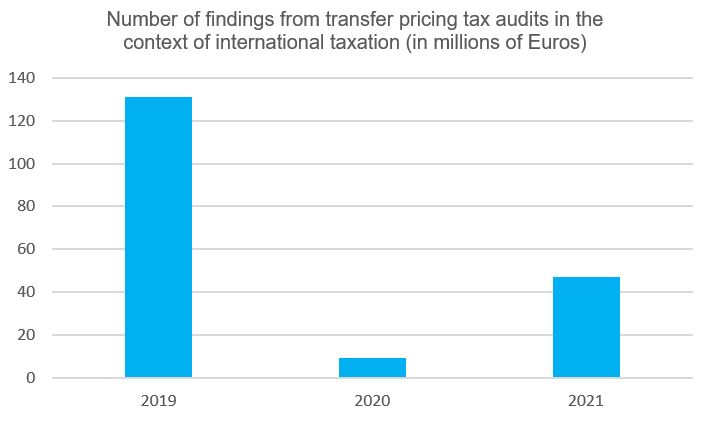

This growing trend can also be observed on the basis of statistical data on tax audits from the Financial Administration’s Open Data portal. In 2021, a total of 46 tax audits focusing on transfer pricing in the context of international taxation were completed, of which more than 75% were concluded with a finding (35). The amount of the total findings (in EUR) in 2021 exceeded EUR 46 million, representing average findings of more than EUR 1.3 million for each completed tax audit.

Source: Financial Administration’s Open Data portal (financnasprava.sk)

—

Should you have more questions or need advice on transfer pricing, please do not hesitate to contact us at any time. We have an experienced team of experts focusing on transfer pricing and transactions with related parties.

Our transfer pricing services include:

- Comprehensive set-up of transfer pricing methodology as well as its agreement with foreign tax advisors

- Preparation of transfer documentation to the required extent as well as the related defence of group pricing

- Processing of comparability analysis using external databases (e.g. TP Catalyst, Royalty Range) as well as internal client data

- Drafting of opinions and ad-hoc advice on transfer pricing

- Review or update of existing transfer documentation

- Representation of clients in tax audits focused on transfer pricing